Mastering Your Finances: A Guide to Overcoming Debt with Debt Management Advisory

Mastering Your Finances: A Guide to Overcoming Debt with Debt Management Advisory

Introduction :

Debt can feel overwhelming, but with the right strategies and guidance from debt management advisors, you can regain control of your financial situation. In this blog, we’ll explore actionable steps to overcome debt and achieve long-term financial stability, all while leveraging the expertise of debt management advisors.

Assess Your Debt Situation :

Before taking any steps, it’s crucial to assess your debt situation comprehensively. Make a list of all your debts, including outstanding balances, interest rates, and minimum payments. Debt management advisors can help you gather this information accurately, providing a clear picture of your financial obligations.

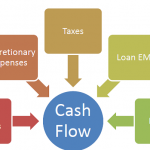

Create a Realistic Budget :

A solid budget is the cornerstone of effective debt management. Work closely with debt management advisors to create a realistic budget that covers essential expenses while allocating extra funds towards debt repayment. Their expertise ensures your budget is tailored to your financial situation, maximizing your ability to pay off debts.

Explore Debt Consolidation :

Debt management advisors can guide you through debt consolidation options, streamlining multiple debts into a single payment. This simplifies your financial landscape and might lead to lower interest rates. They’ll help you understand the pros and cons of various consolidation methods, allowing you to make an informed decision.

Negotiate with Creditors :

Debt management advisors are skilled negotiators. They can liaise with your creditors to potentially lower interest rates, waive fees, or even negotiate a more manageable repayment plan. This expertise can significantly alleviate your debt burden and make your journey to financial freedom smoother.

Set Up a Debt Repayment Plan :

Collaborate with your debt management advisor to establish a structured debt repayment plan. They’ll help you prioritize debts based on interest rates and balances. With their guidance, you’ll know which debts to tackle first, optimizing your strategy for maximum impact.

Stay Disciplined and Consistent :

Overcoming debt requires discipline. Debt management advisors offer ongoing support, helping you stay on track and adjust your plan if necessary. Their encouragement and accountability play a vital role in your debt-free journey.

Focus on Financial Education :

A key aspect of debt management is learning how to make informed financial decisions. Debt management advisors can educate you about money management, budgeting, and responsible credit use. This knowledge equips you with the skills to prevent future debt and maintain financial wellness.

Conclusion :

With the guidance of debt management advisors, your journey to overcoming debt becomes less daunting. By assessing your situation, creating a budget, exploring consolidation, negotiating with creditors, and staying disciplined, you can pave the way to a debt-free future while building a solid financial foundation.

Remember, seeking advice from experienced professionals is a sign of strength on your path to financial independence.

Previous Post

Previous Post Next Post

Next Post